The Tariff Turning Point

The Week Ahead - January 12, 2026

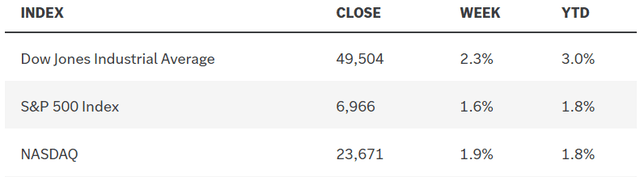

I can’t remember a better start to a new year for the stock market than we have had in 2026. Last week, the S&P 500, Dow Jones Industrials, and Russell 2000 closed at new all-time highs. Market breadth continues to improve, as evidenced by leadership in small-cap stocks. There are multiple tailwinds working in concert to drive the broad market higher. Earnings estimates for the S&P 500 have been on the rise. Fiscal stimulus in the form of tax cuts and investment incentives is now in effect. Additional rate cuts from the Federal Reserve are ahead of us. All of these support higher risk asset prices. The one exception is our labor market, which has been the Achilles heel of this economic expansion in recent months, and Friday’s jobs report for December was a case in point.

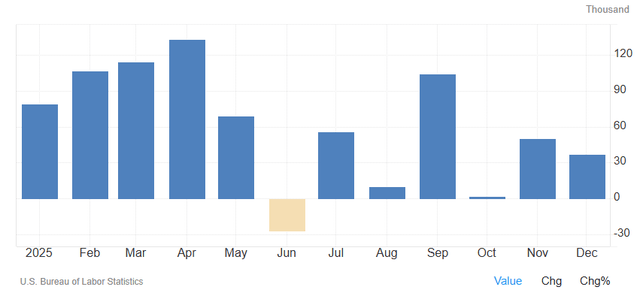

According to the Bureau of Labor Statistics, the economy created just 50,000 jobs last month, which brings the total for last year to 584,000. That is the lowest number since 2009 outside of the pandemic and well below the more than two million created in 2024. The fact that job creation dropped sharply immediately following the implementation of tariffs in April is no coincidence. The private sector created just 37k jobs per month during the last eight months of 2025, while the average was 108k during the first four months. This stagnation was also due to immigration policies and to a lesser extent displacement from AI development.

I am not overly concerned about the lack of job growth at the moment, because the wealth effect is fueling a healthy level of consumer spending and supporting the economic expansion.